![Sell Your House To Investor {market_city]](https://image-cdn.carrot.com/uploads/sites/20714/2025/06/Cash-Home-Buyers-Utah-02.jpg)

Selling your house in Utah, can feel overwhelming, especially when you’re thinking about going the investor route. Maybe your place needs a little work, or maybe you’re just done with the whole process of open houses, agents, and endless showings. You’re probably wondering, “What would an investor even pay for my house?”

Let’s break it down in plain language no jargon, no sugarcoating just a real look at how these numbers come together, what factors matter most, and how you can figure out a ballpark offer before anyone even steps foot inside.

Why Investors Don’t Pay Market Price—and Why That’s Not Always a Bad Thing

First, let’s address the elephant in the room. No, investors usually won’t offer you full market value. That might sound like a loss on your part, but wait a second, think about what you’re saving.

You’re not paying:

- Realtor commissions

- Closing costs

- Months of mortgage, taxes, and utilities while waiting to sell

- Repair costs to get the place “market ready”

Understanding How Investors Calculate Offers in Utah

Most investors use a simple formula, and it’s called the MAO—Maximum Allowable Offer. This is the most they’re willing to pay for a property, and it’s based on three core pieces of information:

- ARV (After Repair Value) – What your home could sell for after renovations.

- Repair Costs – How much work the investor thinks your house needs.

- Margin – The profit they need to make it worthwhile (usually 20–30%).

Let’s break it down.

Basic Investor Formula

MAO = ARV - Repair Costs - Profit MarginLet’s use an example to bring this to life.

Sample Home Sale Calculation Table

| Factor | Amount |

|---|---|

| After Repair Value (ARV) | $300,000 |

| Estimated Repairs | $40,000 |

| Investor’s Margin (25%) | $75,000 |

| Maximum Offer (MAO) | $185,000 |

So, even though your house might be worth $300K once fixed up, the investor needs room to do repairs and make a profit. That’s why you might be offered $180K–$190K.

What Impacts the Offer You’ll Get in Utah?

Every property is unique, but these are the key things that shape an investor’s offer:

1. Condition of the Home

This is a big one. A freshly updated house? Less work, higher offer. A place that needs a new roof, HVAC, and kitchen? Expect a lower number.

If you want to do a quick self-check, walk through your home with this mindset: If I were buying this today, what would I fix? That’s what the investor is thinking too.

2. Neighborhood Trends

Investors look at local data. If houses in your Utah neighborhood are flying off the market for high prices. But if it’s a slower or declining area, they have to play it safe with their offer.

3. Time and Risk

The longer it might take to sell the home after repair, or the more risk the investor sees in your location, the lower the offer. Some areas carry higher holding costs or permit hurdles, and that all gets baked into what they’re willing to pay.

When Should You Reach Out to an Investor in Utah?

Not every situation makes sense for an investor sale. But if you’re dealing with any of the following, it might be the fastest, smartest move:

- You inherited a house and just want to move on

- Your home needs repairs you can’t afford

- You’re relocating quickly

- You just want a simple, quick sale

If any of those sound familiar, getting a quote doesn’t cost anything. You can reach out to a company like Fast Home Offer Utah, who’ll give you a fair offer based on your home’s real condition.

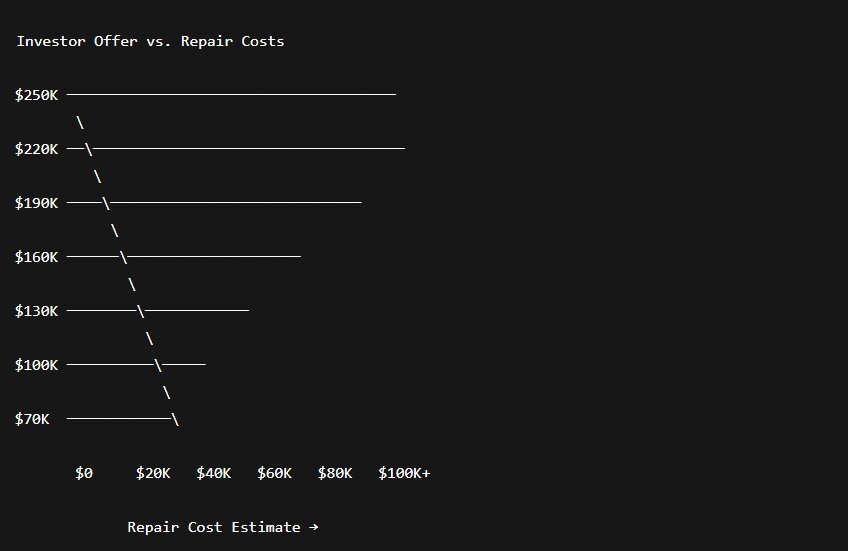

A Simple Graph: How Repairs Impact Your Offer

Let’s visualize how your offer drops as the repair cost increases:

As the repair costs go up, your offer goes down because the investor has to budget more upfront and reduce risk.

Questions You Should Ask Before Accepting Any Offer

When you do decide to speak with an investor, make sure you’re informed. Ask them:

- How did you come up with this number?

- Are there any fees or commissions?

- How fast can you close?

- Will I need to make repairs or clean the house?

A good, reputable investor won’t dodge these. In fact, they should be upfront and walk you through their process.

Should You Get Multiple Offers?

Absolutely. Even though the investor route is fast, it doesn’t mean you should rush. Try to talk to 2–3 buyers before deciding. This helps you:

- Compare offers

- Understand who you trust

- Make sure you’re not underselling too much

Some investors may try to give a high offer just to lock you in, then lower it later after inspection. That’s a red flag. Others will give you a firm, honest price from the start. Those are the ones you want.

Final Thoughts: Know the Numbers, Know Your Worth

Selling to an investor in Utah can be a smart move, but only if you go in with your eyes open. Know your ARV, be realistic about repairs, and don’t be afraid to ask questions.

Most importantly, understand that the offer isn’t just about price it’s about convenience, speed, and peace of mind.

Sometimes, taking a little less on paper can mean a whole lot more for your life. If you’re trying to skip the headache and want an easy, stress-free way to sell, companies like Fast Home Offer Utah can walk you through your options without pressure.